September 20, 2024

Single & Multi-member Llc Taxes

Our complete enterprise tax calculator helps you understand and examine the tax implications of various business entity constructions. This is essential for selecting the best enterprise entity and optimizing your total tax strategy. You can use the IRS’ Estimated Tax Worksheet that will assist you calculate your estimated corporate revenue taxes. There are many issues taxpayers must know when submitting business taxes for an LLC for the primary time. The IRS units deadlines for estimated tax payments on a quarterly basis. Being self-employed comes with a selection of challenges — together with estimated taxes.

Our small business tax calculator quickly gives you a clearer picture of all of your estimated tax refund or tax liability. They move earnings to house owners’ private tax returns, with self-employment tax on self-employment earnings. This means that the corporate pays taxes on its profits, and then the shareholders—the house owners of the C-corp—pay earnings taxes on their dividends and capital positive aspects. A C Corporation or a C Corp is a tax classification that LLCs may opt into to exchange https://www.intuit-payroll.org/ their default status.

The magic occurs when our intuitive software and actual, human support come together. Book a demo at present to see what running your corporation is like with Bench. Be A Part Of 1000’s of entrepreneurs who trust MicahGuru for their enterprise formation needs. The Social Safety tax is 12.4% on revenue up to \$128,400 in 2024, with each worker and employer contributions. Self-employment taxes encompass the Social Security tax and the Medicare tax. Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming.

However, in some states, these taxes may be notably onerous. Additionally generally identified as Federal Unemployment Insurance Coverage, this tax only applies to LLC owners which have changed their tax construction. Part of the group generally recognized as “Payroll Taxes”, it’s solely relevant to W2, salaried workers. The second part of the Self-Employment Tax, Medicare, is a much smaller 2.9% tax on nearly all your small business revenue. It could be a giant tax for high-income earners as a result of, not like Social Security, there’s no cap.

- Simply estimate what you think your ultimate income and expenses shall be.

- As of 2024, 9 states haven’t any income tax, which we ranked among the many greatest for LLC taxes.

- Latest case law has offered some path as to who is and isn’t topic to self-employment tax in an LLC.

- Primarily, an LLC can be thought of a partnership, sole proprietorship or company.

An LLC can even file Kind 2553 and elect to be taxed as an S corporation. If the members of an LLC consider it could possibly decrease its tax bill by being taxed as a corporation, they’ll file Type 8832 with the IRS and decide to be taxed as a C corporation. Bench simplifies your small enterprise accounting by combining intuitive software that automates the busywork with real, skilled human assist. Determine the optimum cheap salary for S-Corporation house owners to reduce self-employment taxes while sustaining IRS compliance.

Bills:

Whereas every LLC is taken into account a limited legal responsibility company, the sort of firm that it is thought of to be will be how the tax treatment is determined. A restricted legal responsibility company is a business structure that combines the pass-through taxation of a partnership or sole proprietorship with the limited liability safety of an organization. Sure, if you count on to owe $1,000 or extra in taxes for the 12 months. LLC homeowners are usually required to make quarterly estimated tax payments covering each revenue tax and self-employment tax.

Turbotax Online/mobile Offers & Pricing

Our Pros might help ensure you reduce liabilities or maximize your refund. As an LLC, your obligations concerning sales tax collection depend on the state in which you operate. Some states may require LLCs to gather sales tax on their taxable sales, while others might not. It is essential to consult the specific regulations of your state’s tax authority to discover out your obligations precisely. Calculate Social Security and Medicare taxes for self-employed people and business owners with comprehensive planning insights.

To guarantee you’re maximizing your savings, yow will discover a qualified tax lawyer through UpCounsel for customized guidance. Decide the LLC’s web revenue by subtracting all allowable business bills from gross income. This contains COGS, working bills, depreciation, and different deductible business costs. The W-4 is a kind crammed out by an employee initially of a job to let the employer know the way much tax should be withheld from every paycheck. Many people nonetheless favor bodily checks, and people are accepted as nicely.

By figuring out how taxes are dealt with with LLCs, you’ll be able to higher understand their tax benefits. You can also work immediately with a financial advisor to assist you choose the best tax route for your corporation that can have a constructive impact in your personal taxes. Starting an LLC might help you scale back your private legal responsibility whereas sustaining management of your small business, but LLCs are thought of pass-through entities for tax purposes. If you’re thinking about beginning an LLC, study more about pass-through entities and the method to file taxes for an LLC.

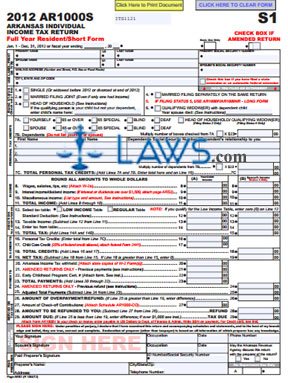

If you run an LLC by your self and haven’t opted to file your taxes as a corporation, you file your federal earnings taxes as a sole proprietor would. This means reporting your revenue and expenses on your personal earnings tax return (Form 1040). When you file as a sole proprietor, you pay taxes based mostly in your private revenue tax price. An LLC (or “restricted legal responsibility company”) is a enterprise entity that behaves like a company on the state level however can avoid paying corporate taxes. As an LLC, your company can pay income tax like a partnership or sole proprietorship within the eyes of the Inside Income Service. Calculate taxes for LLC’s, corporations electing Subchapter S tax treatment (S-Corps), and companies not making Subchapter S elections (C-Corps).